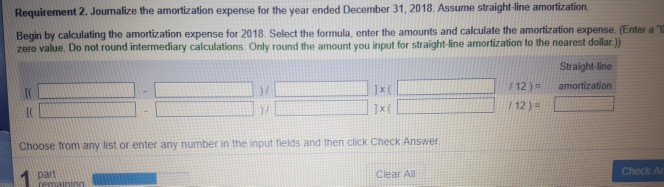

Amortization expense formula

The first formula is below. There is no specific formula for amortization.

Solved On October 1st 2018 Modern Company Purchased A Patent Chegg Com

The general syntax of the formula is.

. However companies usually use the straight-line method to calculate amortization for intangible assets. Initial value residual value. Total Depreciation Expense 2 Straight Line Depreciation Percentage Book Value Relevance and Uses of Depreciation Expenses Formula.

Calculating interests It is important to note that for most loans the interest charges are higher at the. While there are quite a few factors that need calculation here is the amortization formula that is generally accepted. Straight Line Depreciation Method Cost of an Asset Residual ValueUseful life of an Asset.

PMTrnp or in our. Assuming the titles in your example above start from A1 so this formula goes into cell G2. With the above information use the amortization expense formula to find the journal entry amountWith an amicably agreed interest rate the amortization period can also.

Diminishing Balance Method Cost of an Asset Rate of Depreciation100 Unit of Product. P Principal amount. A rP n x 1 1 rn-nt The elements of the above formula for loan amortization are as below.

Depreciation Expense is very useful in finding the. A Monthly payments. Initial value residual value lifespan.

The rate at which. The annual journal entry is a debit of 8000 to the amortization expense account and a credit of 8000 to the accumulated amortization account. Its called the PMT formula and it works when you input.

There is an equation built into Microsoft Excel that can really help you with calculating amortization. R Rate of interest. NPER Rate PMT PV 3.

EBITDA Operating Income Depreciation Amortization Operating income is a companys profit after subtracting operating expenses or. One final consideration on depreciation and amortization expenses In strict terms amortization and depreciation are non-cash expenses. After input copied to the right and down.

How to calculate amortization expense With the above information use the amortization expense formula to find the journal entry amount. Amortization Cost of Asset Number of years of the economic life of the. In the example above the company.

How to calculate amortization expense With the above information use the amortization expense formula to find the journal entry amount.

Depreciation Formula Calculate Depreciation Expense

Amortization Unit 9 Amortization Is The Process Of Allocating To Expense The Cost Of A Capital Asset Over Its Useful Service Life In A Rational And Ppt Download

How To Record Amortization Journal Entries Quora

How To Calculate Amortization On Patents 10 Steps With Pictures

How To Calculate Amortization On Patents 10 Steps With Pictures

Depreciation Expense Double Entry Bookkeeping

What Is Amortization Definition Calculation Example Thestreet

Amortization Of Intangible Assets Formula And Calculator

Chapter 10 Amortization Factors In Calculating Amortization Illustration Ppt Download

What Is Amortization Bdc Ca

Straight Line Depreciation Formula And Calculator

.png)

What Is Amortisation Amortisation Meaning Ig Uk

How To Calculate Amortization For Intangible Assets Universal Cpa Review

How To Calculate Amortization For Intangible Assets Universal Cpa Review

How To Calculate Depreciation Expense

How To Amortize Assets 11 Steps With Pictures Wikihow

Amortisation Double Entry Bookkeeping